ENTERPRISE & SUPPLIER DEVELOPMENT

Enterprise & Supplier development is the fourth element that an entity is measured on.

KEY MEASUREMENT PRINCIPLES

- The Enterprise and Supplier Development consist of,

- Preferential Procurement; and

- Enterprise Development and Supplier Development.

- Enterprise Development and Supplier Development Contributions will be recognised as a percentage of annual Net Profit After Tax (NPAT).

SUBMINIMUM AND DISCOUNTING PRINCIPLE

- A Measured Entity must achieve a minimum of 40% of each of the targets set out on 2.1, 2.2 and 2.3 excluding bonus points of the Enterprise and Supplier Development Scorecard.

- Non-compliance to the threshold targets will result in the overall achieved B-BBEE status level being discounted in accordance with paragraph 3.4 in statement 000.

An Empowering Supplier within a context of B-BBEE is a B-BBEE compliant entity, which is a good citizen South African entity, comply with all regulatory requirements of the country and should meet at least three if it is a large enterprise or one if it is a QSE of the following criteria:

(a) At least 25% of cost of sales excluding labour cost and depreciation must be procured from local producers or local supplier in SA, for service industry labour cost are included but capped to 15%.

(b) Job creation – 50% of jobs created are for Black people provided that the number of Black employees since the immediate prior verified B-BBEE Measurement is maintained.

(c) At least 25% transformation of raw material/beneficiation which include local manufacturing, production and/or assembly, and/or packaging.

(d) Skills transfer – at least spend 12 days per annum of productivity deployed in assisting Black EMEs and QSEs beneficiaries to increase their operation or financial capacity.

Exempted Micro Enterprises and Start-Ups are .automatically recognised as Empowering Suppliers.

If a Measured Entity procures goods and services from a supplier that is:

- A recipient of supplier development contributions from a Measured Entity under Code series 400 has a minimum 3 year contract with the Measured Entity, the recognisable B-BBEE Procurement Spend that can be attributed to that Supplier is multiplied by a factor of 1.2;

- A black owned QSE or EME which is not a supplier development beneficiary but that has a minimum 3 year contract with the Measured Entity, the recognisable B-BBEE Procurement Spend that can be attributed to that Supplier is multiplied by a factor of 1.2;

- A first time supplier to the Measured Entity, the recognisable B-BBEE Procurement Spend that can be attributed to that Supplier is multiplied by a factor of 1.2.

Procurement of goods and services and any other activities that fall under PREFERENTIAL PROCUREMENT will not qualify for scoring under ENTERPRISE DEVELOPMENT and SUPPLIER DEVELOPMENT and vice versa.

Beneficiaries of Supplier Development and Enterprise Development are EMEs or QSEs which are at least 51% black owned or at least 51% black women owned.

GENERAL PRINCIPLES

- To strengthen local procurement in order to help build South Africa’s industrial base in critical sectors of production and value adding manufacturing, which are largely labour-intensive industries.

- To increase local procurement through capacity building achieved by incentivising appropriate local supplier development programmes by businesses supplying imported goods and services.

- The imports provisions do not apply to the designated sectors and products for local production, as and when published.

- To actively support procurement from black owned QSEs and EMEs by identifying opportunities to increase procurement from local suppliers in order to support employment creation.

- To support procurement from black owned and black women owned businesses in order to increase the participation of these businesses in the main stream economy.

- To promote the use of black owned professional service providers and entrepreneurs as suppliers.

- Measured Entities receive recognition Development and Supplier Development for any Enterprise Contributions that are quantifiable as a monetary value using a Standard Valuation Method.

- Measured Entities are encouraged to align their Enterprise Development and Supplier Development initiatives with the designated sectors of government’s localisation and value adding programmes.

- Measured Entities are encouraged to align their enterprise development and supplier development initiatives with their supply chain requirements thereby linking Enterprise Development and Supplier Development with Preferential Procurement.

- Qualifying Enterprise Development and Supplier Development Contributions of any Measured Entity are recognisable on an annual basis.

- Contributions, programmes and/or initiatives that span over multiple years, the total contribution amount must be divided by the number of years, and the average per year is then to be utilised for the annual contribution.

- Measured Entities are encouraged to develop and implemented an Enterprise Development plan and Supplier Development plan for Qualifying Beneficiaries. The plan should include:

- Priority interventions

- Key performance indicators; and

- A concise implementation plan with clearly articulated milestones.

- Measured Entities will not get recognition for the same activities undertaken under 2.2 and 2.3, they will only get recognition for one of the two i.e. 2.2 or 2.3

- No portion of the value of any Qualifying Enterprise Development and Supplier Development Contribution that is payable to the beneficiary after the date of measurement can form part of any calculation under this statement.

TOTAL MEASURED PROCUREMENT SPEND

The following procurement is measurable within Total Measured Procurement Spend:

- Cost of sales: all goods and services procured that comprise the cost of the sales of the Measured Entity,

- Operational expenditure: all goods and services procured that comprise the operational expenditure of the Measured Entity;

- Capital expenditure: all capital expenditure incurred by the Measured Entity;

- Public sector procurement:

- all goods and services procured from organs of state and public entities Despite this, procurement by a Measured Entity from a local government authority, which is a reseller of that service, is measurable at the B-BBEE Recognition Level of the primary Supplier of the service; and

- in any event, any procurement of any goods or services from any organ of state or public entity that enjoys a statutory or regulated monopoly in the supply of such goods or services, is excluded;

- Monopolistic procurement: all goods and services procured from suppliers that enjoy a monopolistic position;

- Third-party procurement: all procurement for a third-party or a client, where the cost of that procurement is an expense recorded in the Measured Entity’s annual financial statements;

- Labour brokers and independent contractors: any procurement of the Measured Entity which is Outsourced Labour Expenditure;

- Pension and medical aid contributions: payments made to any post retirement funding scheme or to a medical aid or similar medical insurer by a Measured Entity for its employees, excluding any portions of such payments which are a contribution to a capital investment of the employee. The scheme or insurer must issue a certificate dividing payments between the capital investment portion and the balance to establish the amount that is measurable within Total Measured Procurement Spend;

- Trade commission’s: any commission or similar payments payable by a Measured Entity to any other person pursuant to the business or trade of the Measured Entity;

- Empowerment related expenditure: all goods and services procured in carrying out B-BBEE. The Total Measured Procurement Spend does not include the actual contribution portion recognised under section 2.2 and 2.3 of this statement or Code series 500 but does include any expenditure incurred in facilitating those contributions;

- Imports: all goods and services that are imported or procured from a non-South African source; and

- Intra-group procurement: all goods and services procured from subsidiaries or holding companies of the Measured Entity (BEE credentials of the entity supplying goods and/or services must be confirmed by way of a valid BEE certificate).

EXCLUSIONS FROM TOTAL MEASURED PROCUREMENT SPEND

The following list provides permissible exclusions from Total Measured Procurement Spend recognisable in terms of paragraph 5:

- 6.1 Taxation: any amount payable to any person which represents a lawful tax or levy imposed by an organ of state authorised to impose such tax or levy, including rates imposed by a municipality or other local government;

- Salaries, wages, remunerations, and emoluments: any amount payable to an employee as an element of their salary or wage and any emolument or similar payment paid to a director of a Measured Entity;

- Pass-through third-party procurement: all procurement for a third-party or a client that is recorded as an expense in the third-party or client’s annual financial statements but is not recorded as such in the Measured Entity’s annual financial statements;

- Empowerment related procurement:

- Investments in or loans to an Associated Enterprise;

- Investments, loans or donations qualifying for recognition under any statement under Code series 400 or 500;

- Imports: the following imported goods and services:

- imported capital goods or components for value-added production in South Africa provided that:

- there is no existing local production of such capital goods or components; and

- importing those capital goods or components promotes further value-added production within South Africa;

- imported goods and services other than those listed in paragraph 6.5. 1 if there is no local production of those goods or services including, but not limited to, imported goods or services that –

- carry a brand different to the locally produced goods or services; or

- have different technical specifications to the locally produced goods or services.

- imported capital goods or components for value-added production in South Africa provided that:

- The exclusion of imports listed under 6.5.2 are subject to them having developed and implemented an Enterprise Development and Supplier Development plan for imported goods and services. This plan should include:

- Clear objectives

- Priority interventions

- Key performance indicators; and

- A concise implementation plan with clearly articulated milestones

- The Department of Trade and Industry will from time to time consult with the industry and issue practice notes with regard to the provisions on import exclusion.

MEASUREMENT OF B-BBEE PROCUREMENT SPEND

- B-BBEE Procurement Spend is the value of the procurement falling within paragraph 5 and not excluded by paragraph6. If a supplier falls within a category of supplier listed in paragraph 3.5, the value of procurement from that supplier is multiplied by the applicable factor listed in that paragraph.

- B-BBEE Procurement Spend can be measured in terms of formula “A” in Annexe 400(A).

- The B-BBEE Procurement Spend for a Measured Entity in respect of a supplier is calculated by multiplying the spend contemplated by paragraph 5 (and not excluded by paragraph 6) in respect of that supplier by the supplier’s B-BBEE Recognition Level.

- A Measured Entity’s Total Procurement Spend is the total of all amounts calculated in terms of paragraph 7.3.

THE CALCULATION OF PREFERENTIAL PROCUREMENT CONTRIBUTIONS TO B-BBEE

- A measured Entity receives a score for procurement in proportion to the extent that it meets the compliance target.

- The Measured Entity’s score for Preferential Procurement contributions to B-BBEE under the preferential procurement scorecard can be calculated in terms of formula “B” in Annexe 400(A).

Enterprise DEVELOPMENT and SUPPLIER DEVELOPMENT CONTRIBUTIONS

The following is a non-exhaustive list of Enterprise Development and Supplier Development Contributions:

- investments in beneficiary entities;

- loans made to beneficiary entities;

- guarantees given or security provided on behalf of beneficiaries;

- credit facilities made available to beneficiary entities;

- grant Contributions to beneficiary entities;

- direct costs incurred by a Measured Entity in assisting and hastening development of beneficiary entities;

- overhead costs of a Measured Entity directly attributable to Enterprise Development and Supplier Development Contributions;

- preferential credit terms granted by a Measured Entity to beneficiary entities;

- preferential terms granted by a Measured Entity in respect of its supply of goods or services to beneficiary entities;

- contributions made to settling service costs relating to the operational or financial capacity or efficiency levels of beneficiary entities;

- discounts given to beneficiary entities in relation to the acquisition and maintenance costs associated with the grant to those beneficiary entities of franchise, licence, agency, distribution or other similar business rights;

- the creation or development of capacity and expertise for beneficiary entities needed to manufacture or produce goods or services previously not manufactured, produced or provided in the Republic of South Africa is provided for in Government’s economic growth and local supplier development policies and initiatives;

- facilitating access to credit for beneficiary entities without access to similar credit facilities through traditional means owing to a lack of credit history, high-risk or lack of collateral;

- provision of training or mentoring by suitably qualified entities or individuals to beneficiary entities which will assist the beneficiary entities to increase their operational or financial capacity; and

- the maintenance by the Measured Entity of an Enterprise Development and Supplier Development unit which focuses exclusively on support of beneficiary entities or candidate beneficiary entities.

- new projects promoting beneficiation by the Measured Entity for the benefit of Enterprise Development and Supplier Development Beneficiaries.

- provision of preferential credit facilities to a beneficiary entity by a Measured Entity may constitute an Enterprise Development and Supplier Development Contribution. Examples of such contributions include without limitation:

- provision of finance to beneficiary entities at lower than commercial rates of interest;

- relaxed security requirements or absence of security requirements for beneficiary entities unable to provide security for loans; and

- settlement of accounts with beneficiary entities over a shorter period of time in relation to the Measured Entity’s normal payment period, provided the shorter period is no longer than 15 days;

- providing training or mentoring to beneficiary communities by a Measured Entity. (Such contributions are measurable by quantifying the cost of time (excluding travel or commuting time) spent by staff or management of the Measured Entity in carrying out such initiatives. A clear justification, commensurate with the seniority and expertise of the trainer or mentor, must support any claim for time costs incurred).

- maintaining an Enterprise Development and Supplier Development unit by the Measured Entity. (Only that portion of salaries and wages attributable to time spent by the staff in, and the other expenses related to, promoting or implementing Enterprise Development and Supplier Development constitute contributions.)

- Payments made by the Measured Entity to suitably qualified and experienced third parties to perform Enterprise Development and Supplier Development on the Measured Entity’s behalf.

MONETARY AND NON-MONETARY CONTRIBUTIONS

- Subject always to the definition of Qualifying Enterprise Development and Supplier Development Contributions, the following monetary/non monetary contributions will, without limitation, be considered:

- the provision of seed or development capital;

- contributions made towards the settlement of the cost of services relating to the operational or financial capacity and/or efficiency levels of a Qualifying Enterprise Development and Supplier Development Beneficiary including, without limitation:

- professional and consulting services;

- licensing and/or registration fees;

- industry specific levies and/or other such fees; and

- IT services;

- subject to paragraph 10.1, creation or development of capacity and expertise for Beneficiary Entities required to manufacture or produce goods and/or services previously not manufactured, produced or provided in the Republic of South Africa;

- subject to paragraph 10.2, provision of preferential credit facilities;

- subject to paragraph 10.1, facilitation of access to credit for Beneficiary Entities unable to access similar credit facilities through traditional means owing to a lack of credit history, high risk and/or lack of collateral;

- subject to paragraph 10.3, provision of training and/or mentoring to Beneficiary Entities which will assist the Beneficiary Entities to increase their operational and/or financial capacity; and

- subject to paragraph 10.4, the maintenance by the Measured Entity of an Enterprise Development and Supplier Development unit which focuses exclusively on support of Beneficiary Entities or candidate Beneficiary Entities.

- The creation and/or development of the capacity of Beneficiary Entities which will enable them to manufacture and produce goods and/or provide services previously not available in the Republic of South Africa, may constitute a Qualifying Enterprise Development and Supplier Development Contribution, and will be measured as the rand value of monetary contributions made as well as investments into, loans made to or guarantees given for a Beneficiary Entity.

- Provision of preferential credit facilities to a Beneficiary Entity by a Measured Entity may constitute a Qualifying Enterprise Development and Supplier Development Contribution. Examples of such contributions include without limitation:

- provision of finance to Beneficiary Entities at rates of interest below the applicable rate. Such contributions will be measured as the value of the differential between the actual interest rate provided to the Beneficiary Entity and the applicable rate;

- relaxed security requirements or absence of security requirements for Beneficiary Entities unable to provide security for loans. Such contributions shall be measured as being 3% (three percent) of any positive differential between the initial capital value of the loan and the value of security taken; and

- settlement of accounts with Beneficiary Entities over a shorter period of time in relation to the Measured Entity’s normal payment period, provided that the shorter period is no longer than 15 days, Preferential payment terms which extend beyond 15 days will not qualify as Qualifying Enterprise Development and Supplier Development Contributions.

- Provision of training and/or mentoring to a Beneficiary Entity by a Measured Entity may constitute a Qualifying Enterprise Development and Supplier Development Contribution. Such contributions will be measured by quantifying the cost of time spent by staff or management of the Measured Entity in carrying out such initiatives. Any travel or commuting time may not be included in this cost Furthermore, a clear justification must be supplied with respect to the calculation of such time costs incurred, commensurate with the level of seniority and, expertise of the trainer or mentor. Common forms of such contribution include without limitation:

- Professional and consulting services;

- IT services; and

- any other services which help to increase the entity’s financial and/or operational capacity and which have not also been accounted for under skills development

- The maintenance of an Enterprise Development and Supplier Development unit by the Measured Entity may constitute a Qualifying Enterprise Development and Supplier Development Contribution.Common examples of such contributions include without limitation the salaries and wages of staff and other expenses involved in the operation of such Enterprise Development and Supplier Development unit. Notwithstanding the afore going, only that portion of salaries and wages which relate to time spent by the staff in and the other expenses related to the promotion and implementation of Enterprise Development and Supplier Development in respect of Beneficiary Entities or candidate Beneficiary Entities should be taken into consideration under Enterprise Development and Supplier Development contributions.

Click here to contact us with your enquiry

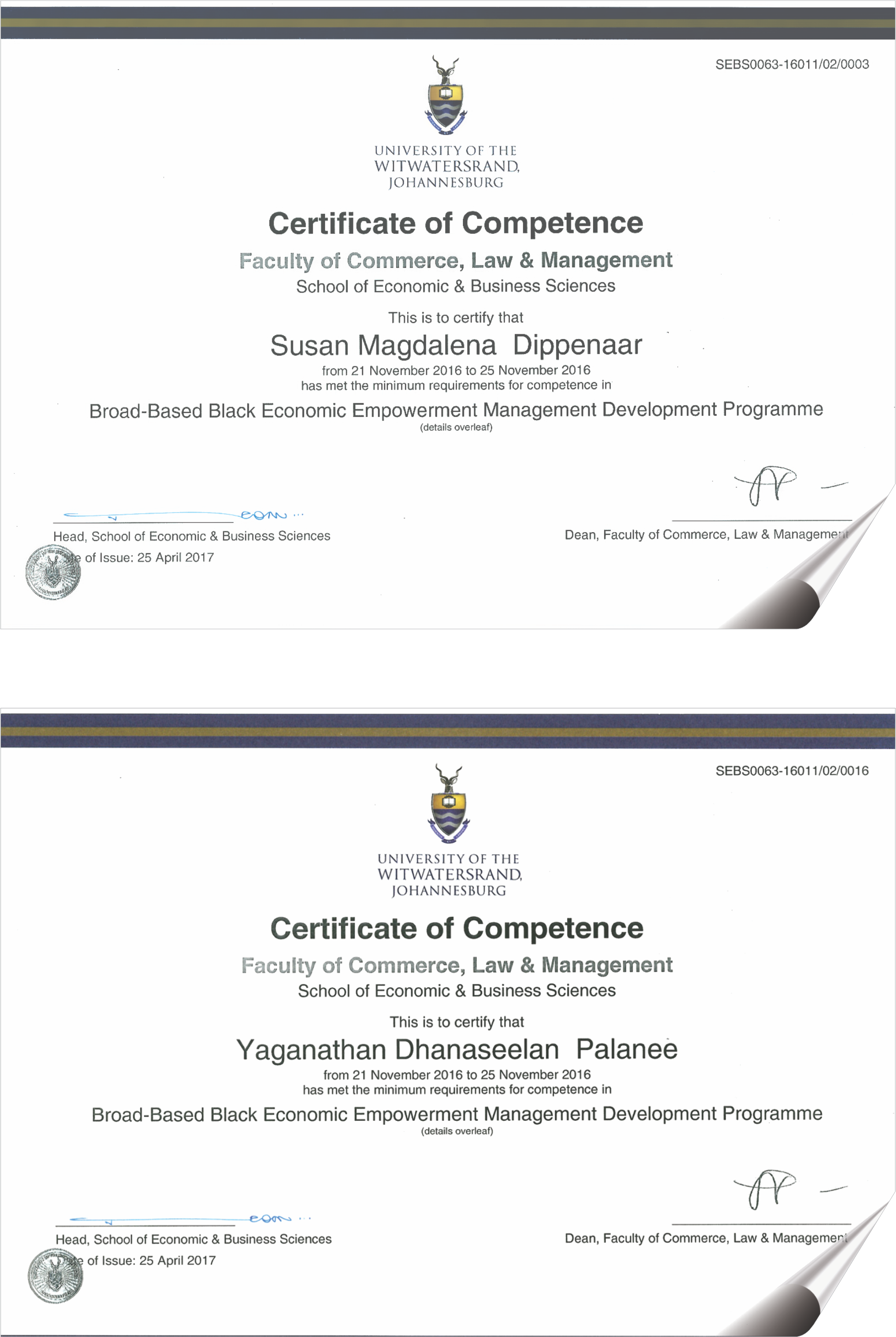

our CREDENTIALS

WITS B-BBEE MANAGEMENT DEVELOPMENT PROGRAMME